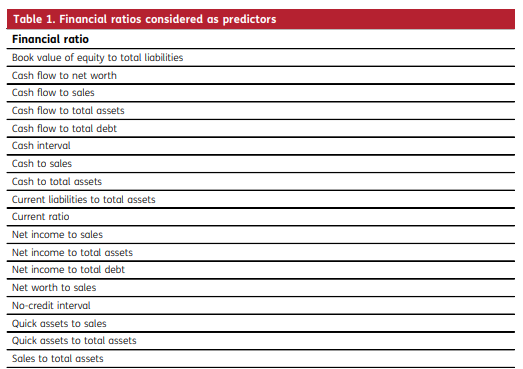

This paper explores the properties of using a generalized additive model with embedded variable selection for the prediction of bankruptcy. The main purpose is to explore an innovative way to close the gap between interpretation and prediction that has prevented widespread use of methods based on machine learning. An additive model enables the incorporation of nonlinear effects for each predictor, thereby enhancing the predictive power over classical linear models, while simultaneously keeping the marginal effects for interpretation separated. In addition, we propose a penalization likelihood approach that automatically selects important financial ratios and classifies them under linear and nonlinear effects, thereby improving the interpretation of the estimations.

https://www.tandfonline.com/doi/pdf/10.1080/23322039.2019.1597956